Ethereum Price Prediction: Will ETH Shatter $4,000 Amid Institutional Frenzy?

#ETH

- Technical Breakout: ETH price hovering near upper Bollinger Band with narrowing MACD suggests impending volatility

- Institutional Demand: $60M+ institutional inflows in July create strong bid support

- Market Sentiment: NFT market revival and Layer-2 innovations (Linea's Etherdex) boost ecosystem value

ETH Price Prediction

ETH Technical Analysis: Bullish Momentum Building

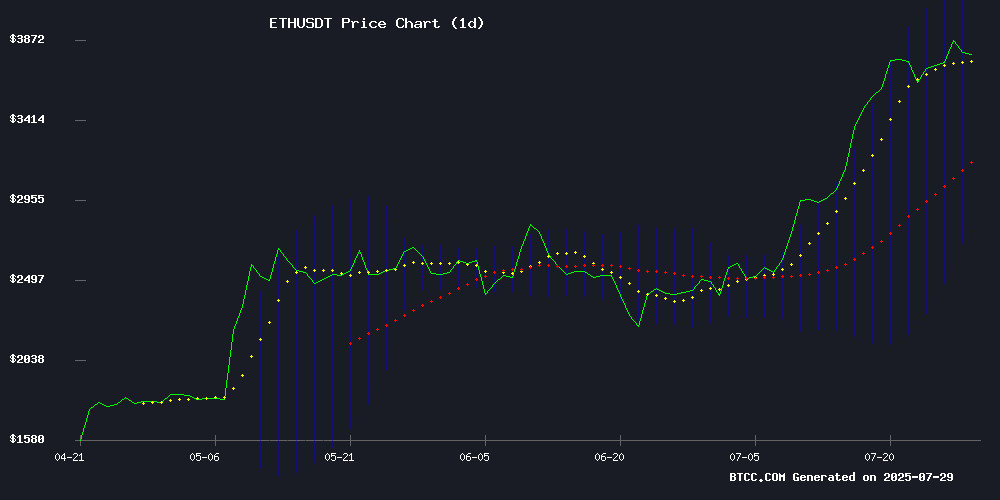

According to BTCC financial analyst Ava, Ethereum's current price of $3,853.90 sits comfortably above its 20-day moving average of $3,477.75, signaling underlying strength. The MACD histogram remains negative but shows narrowing bearish momentum (-16.67), while price trades NEAR the upper Bollinger Band ($4,153.81) – a classic indicator of potential upside volatility.

Institutional Accumulation Fuels Ethereum Optimism

BTCC's Ava highlights a surge in institutional interest as ARK Invest's $18.6M BitMine purchase and Trump-backed WLF's additional $1M ETH allocation join a $40M whale accumulation. With SharpLink Gaming's pivot to ethereum and exchange reserves shrinking, Ava notes 'these capital inflows create fundamental support despite short-term overbought conditions.'

Factors Influencing ETH’s Price

ARK Invest Expands Ether Exposure with $18.6M BitMine Purchase Amid Market Dip

ARK Invest, led by Cathie Wood, seized the recent downturn in BitMine Immersion Technologies (BMNR) to bolster its ether-focused holdings. The firm acquired 529,366 BMNR shares worth $18.6 million across its ARKK and ARKW ETFs, signaling continued institutional confidence in Ethereum's treasury strategy.

BitMine's stock has plummeted 74% from its $135 peak earlier this month, now trading at $35.11. The company has emerged as a major corporate accumulator of ether, amassing over 300,000 ETH valued at more than $1 billion. This mirrors Michael Saylor's bitcoin treasury playbook at MicroStrategy.

Ether's price surge of 57% in July to nearly $3,900 reflects growing adoption of corporate ETH treasuries. ARK simultaneously trimmed positions in Coinbase ($7M) and Block ($15M), reallocating toward its conviction in Ethereum's institutional narrative.

Trump-Backed WLF Buys $1M More in Ethereum: Reports

Ethereum's institutional appeal continues to grow as World Liberty Financial, a crypto firm linked to the Trump family, purchases an additional 256.75 ETH for $1 million. The acquisition, executed at approximately $3,895 per coin, brings the firm's total holdings to 77,226 ETH—valued at $296 million with unrealized profits nearing $41.7 million.

The cryptocurrency has surged 105% over three months, outpacing rivals as institutional interest intensifies. "We're witnessing institutional FOMO—big players rushing in ahead of potential ETF approvals," noted crypto analyst Wilson Ye. Ethereum's evolution into core infrastructure for institutions appears increasingly undeniable.

Whale Buys $40M Ethereum as Accumulation Gains Momentum

A significant Ethereum transaction has captured market attention as a new whale withdrew 11,370 ETH worth $40 million from Coinbase Prime. The purchase, executed at an average price of $3,811, generated an immediate $400,000 profit.

This activity aligns with a broader trend of institutional accumulation, with over $2.38 billion in ETH acquired since July. Analysts attribute the surge to growing spot ETF inflows and heightened institutional demand, reflecting strengthened confidence in Ethereum's fundamentals.

The movement suggests anticipation of potential market catalysts, as large-scale investors position themselves ahead of expected developments in the Ethereum ecosystem.

Pepeto vs BlockDAG Showdown Heats Up as Presale Frenzy Pushes Pepeto Toward Record-Breaking Growth

The meme coin market is witnessing a fierce rivalry between Pepeto and BlockDAG, with Pepeto emerging as a frontrunner. Backed by Ethereum's traction, Pepeto has raised significant funds, creating substantial FOMO among retail and early-stage investors.

Unlike BlockDAG, which relies on hype, Pepeto is building momentum with a robust ecosystem designed to reshape meme coin trading. Its utility-driven approach rewards early backers with entry at the lowest possible price, positioning it as a potential x100 opportunity.

Pepeto's strategy mirrors the success of past meme coins like Shiba Inu and Dogecoin, turning modest investments into life-changing gains. Supporters are betting on its proven formula rather than exaggerated branding, making it a standout in the crowded meme coin space.

Ethereum Enters New Institutional Chapter as Joe Lubin Leads SharpLink Gaming’s Pivot

Ethereum co-founder Joe Lubin has quietly assumed the role of chairman at SharpLink Gaming, a NASDAQ-listed company shifting from sports betting to building an Ethereum-focused treasury. This move signals a broader institutional embrace of Ethereum, with Lubin positioning it as a cornerstone of programmable finance.

"We’ll accumulate more Ether per fully diluted share much faster than any other Ethereum-based project," Lubin told Bloomberg Television. The statement underscores Ethereum’s evolution from a speculative platform to a critical financial infrastructure component, buoyed by staking, smart contracts, and regulatory clarity.

Institutions are now integrating Ethereum into treasury strategies, moving beyond mere exploration. SharpLink’s pivot reflects a growing trend of companies treating ETH not just as a store of value but as operational fuel for decentralized systems.

Ethereum Pulls Back from $3,900 High as Exchange Reserves Shrink

Ethereum retreated 3.7% from its July 28 peak of $3,933, trading at $3,786 amid broader crypto market fluctuations. Despite the dip, ETH remains up 56% over the past month—a rally now showing signs of short-term exhaustion.

Exchange reserves tell a bullish story: over 1 million ETH exited custodial platforms in 30 days, the equivalent of $3.8 billion at current prices. This mass withdrawal typically precedes price appreciation as sell pressure diminishes.

Derivatives markets reveal nuanced sentiment. While open interest slipped 1.45% to $57.5 billion, futures volume surged 28% to $111 billion—a pattern suggesting profit-taking rather than bearish positioning. ETF inflows continue absorbing available supply.

Billions Flow Into Crypto Amid Institutional ETH Accumulation, but 10x Research Flags Caution

Cryptocurrency markets have surged to a $3.89 trillion capitalization as institutional investors aggressively accumulate Ethereum, with public companies now holding over $5 billion in ETH. Bitmine leads with $2.2 billion in holdings, followed by Sharplink and Bit Digital—collectively controlling 1.06% of ETH's circulating supply. Ether Machine's anticipated $1.6 billion entry could further tighten institutional grip.

Beneath the bullish headlines, 10x Research identifies troubling microtrends: declining NAV premiums, weakening funding rates, and shifting volumes suggest a potential summer slowdown. "These metrics historically precede consolidation," the report notes, contrasting sharply with market euphoria around institutional adoption.

SharpLink’s Joe Lubin Accelerates Ethereum Accumulation to Challenge BitMine

SharpLink Gaming, under the leadership of Ethereum co-founder Joe Lubin, is aggressively expanding its Ethereum reserves in a strategic bid to outpace BitMine Immersion Technologies. The firm employs daily stock offerings to acquire additional ETH while staking existing holdings to generate yield—a disciplined approach that prioritizes sustainable growth over speculative leverage.

This corporate treasury arms race underscores a broader institutional shift: Ethereum is no longer merely a speculative asset, but a foundational component of modern digital finance. SharpLink's methodology—combining equity financing with proof-of-stake rewards—demonstrates how traditional capital markets are converging with crypto-native yield strategies.

CryptoPunks Surge Past $200K Floor Price Amid NFT Market Revival

CryptoPunks, the pioneering Ethereum-based NFT collection, has breached the $200,000 floor price threshold for the first time since March 2024. The 163% rally from August's 20.45 ETH floor reflects renewed institutional interest in blue-chip digital collectibles.

A single entity's acquisition of 45 Punks last week triggered market momentum, coinciding with Ethereum's price stabilizing near $3,745. The sweep transaction—where buyers bulk-purchase NFTs to consolidate supply—echoes strategies seen during previous NFT bull markets.

Ethereum's NFT ecosystem recorded its highest daily volume since February, with $26 million traded on July 20. CryptoPunks dominated activity, accounting for over 50% of total transactions. The resurgence suggests collectors are returning to established projects after months of speculative activity in newer collections.

Etherex Launches as Linea's Innovative Liquidity Hub to Enhance Ethereum's Ecosystem

Etherex, a groundbreaking decentralized exchange (DEX) on Linea, is set to transform liquidity provision within the Ethereum ecosystem. The platform leverages the ve3,3 model to optimize trades and outcomes for token holders, traders, and liquidity providers. Its native token, REX33, enables earning and autocompounding while maintaining deep liquidity—a critical feature for Ethereum's infrastructure growth.

The Ethereum blockchain already hosts over 50% of non-Bitcoin digital assets, alongside a dominant share of stablecoins and DeFi capital. Etherex aims to solidify this position by offering innovative incentive structures and seamless user experiences. Developed in collaboration with Linea, the DEX is poised to play a pivotal role in the network's evolution.

Halmos v0.3.0 Revolutionizes Stateful Invariant Testing for Smart Contracts

Halmos v0.3.0 marks a paradigm shift in smart contract testing with its advanced stateful invariant capabilities. The update eliminates manual workarounds previously required for stateful testing, streamlining the process for developers.

Andreessen Horowitz's crypto arm highlights the tool's new features: automated symbolic calldata generation, expanded state-space exploration, and support for dynamic transaction parameters. These innovations enable deeper analysis of contract behavior under real-world conditions.

The open-source tool now handles complex testing scenarios natively—from arbitrary senders to variable block timestamps—reducing boilerplate code while increasing test coverage. This advancement comes as Ethereum's developer community demands more robust verification methods ahead of its next protocol upgrade.

Will ETH Price Hit 4000?

Ava maintains a cautiously bullish outlook: 'The convergence of technical and fundamental factors suggests ETH could test $4,000 within weeks. However, traders should monitor these key levels:

| Indicator | Value | Implication |

|---|---|---|

| Upper Bollinger | $4,153.81 | Immediate resistance |

| 20-day MA | $3,477.75 | Strong support floor |

| MACD | -16.6737 | Approaching bullish crossover |

While exchange reserve depletion (down 12% monthly) reduces selling pressure, the -524 MACD line warrants caution until we see sustained closes above $3,900.

bullish